In recent years, India has witnessed a seismic shift in how financial services are delivered, consumed, and monetized. At the heart of this transformation is the rise of fintech—a sector projected to reach a market size of $1.5 trillion by 2030, according to EY and Invest India. Yet, amid the digital innovation and AI-powered platforms, one powerful force is often overlooked: the retired banker.

The Evolving Role of Former Bankers

Seasoned banking professionals, once the custodians of legacy systems, are now becoming vital players in India’s fintech revolution. Platforms like BankersKlub are bridging the gap between experience and innovation.

Why Retired Bankers Matter More Than Ever

India is home to over 3 lakh retired bankers who offer:

- Trusted local presence in Tier 1, 2, and 3 cities

- Deep credit acumen and documentation knowledge

- Connections with HNIs, MSMEs, and co-lenders

- Ability to guide borrowers through financial products

From Traditional Banking to Tech-Enabled Advisory

Retirement no longer marks an exit. Today, platforms like BankersKlub empower 2,000+ retired bankers to earn ₹1–2 lakh/month through:

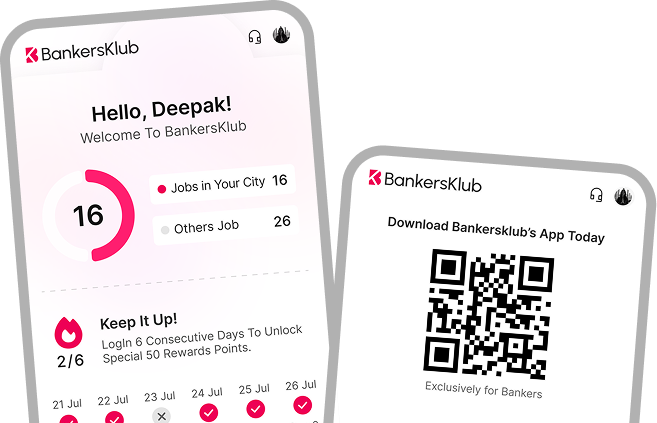

- App-Based Platforms: Mobile-first access and lead management

- Mandate-Based Earnings: Revenue through closures and referrals

- Flexible Engagement: Consultant, advisor, or referral roles

India’s Credit Landscape: A Growing Opportunity

- Retail credit growing at 18–20% CAGR (RBI)

- MSME credit gap: ₹25+ lakh crore (IFC)

- Only 27% of Indians have a formal credit score

Case in Point: Real Impact Stories

- Retired AGM from Union Bank closed ₹5 Cr loan in 3 weeks (Indore)

- Former PNB officer in Ludhiana earns ₹60K–₹1.2L/month via mandates

- Retired SBI zonal manager mobilized ₹1 Cr AIF investments via HNI network

Retired Bankers × Fintech = Win-Win-Win

| Stakeholder | Benefits |

|---|---|

| Retired Bankers | Income generation, continued relevance, flexible working model |

| Fintech Platforms | Domain-led execution, trust-building, lower acquisition cost |

| Customers (Retail/MSME) | Better guidance, faster processing, improved loan accessibility |

Trust, Not Just Technology

While digital tools help scale, trust remains the bedrock of financial transactions. Retired bankers offer credibility, community influence, and human touch—especially for loans and investments.

The BankersKlub Advantage

With over 155+ active consultants and growing, BankersKlub offers:

- A mobile app for mandates and tracking

- Custom training and upskilling

- A “mandate engine” to connect fintechs with experienced bankers

Final Thoughts

As India approaches a $5 trillion economy, retired bankers are not stepping away—they’re stepping up. Their expertise is now central to financial inclusion, credit enablement, and advisory-led distribution.

Explore how BankersKlub can work for you—whether as a banker, partner, or fintech.

Visit www.bankersklub.com for more.